san francisco gross receipts tax estimated payments

Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. Quar terly estimated tax payments of the Gross Receip ts Tax Payroll Expense Tax Commercial Rents Tax and Homelessness Gross Receip ts Tax that would other wise be due on April 30 2020 are waived for taxpayers or combined groups that had combined San Francisco gross receipts in calendar year 2019 of 10000000 or less.

For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021.

. 6 The passage of Proposition F fully repeals the Citys Payroll Expense Tax. Tax and homelessness gross receipts tax that would otherwise be due on april 30 2020 are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of 10000000 or less. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Anatomy Of San. Due Dates for Quarterly Installment Payments. You may pay online through this portal or you may print a stub and mail it with your payment.

In November 2012 San Francisco voters approved Proposition E phasing in a new gross receipts tax and phasing out the citys payroll expense tax over a five-year period starting on Jan. The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from. What to expect for tax season The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

5 The current Payroll Expense Tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the City in 2018. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. The Treasurer and Tax Collectors office of the City of San Francisco announced that quarterly estimated tax payments of the Gross Receipts Tax Payroll Expense Tax Commercial Rents Tax and Homelessness Gross Receipts Tax that would otherwise be due on April 30 2020 are waived for taxpayers or combined groups that had combined San Francisco.

Gross Receipts Tax and Payroll Expense Tax. San francisco gross receipts tax estimated payments. 1 mandatory combined reporting for Payroll Expense Tax.

On November 26 2013 the San Francisco Board of Supervisors approved amendments to the San Francisco Business and Tax Regulations Code Code providing for penalty relief for delinquent Gross Receipts Tax GRT installment payments. The se quarterly estimated tax. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax. The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017. City and County of San Francisco Treasury and Tax Collector website2018 was to be the last year of the payroll expense tax when starting in 2019 businesses were to pay only the gross receipts tax.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. San franciscos gross receipts tax grt is calculated based on individual employees time spent in sf.

9 2019 available here. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. Deferral of Quarterly Business Taxes Due April 30 2020.

On March 11 2020 the City of San Francisco announced measures to support small businesses in light of the COVID-19 outbreak. Estimated tax payments of the Gross Receipts Tax Payroll Expense Tax Commercial Rents Tax and Homelessness Gross Receipts Tax that would otherwise be due on April 30 2020 are waived for taxpayers or combined groups that had combined San Francisco gross receipts in calendar year 2019 of 10000000 or less. Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street.

Friday February 18 2022. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the payment portal within 24 hours of completing your filing. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City.

Specifically the San Francisco Office of the Treasurer Tax Collector is deferring quarterly estimated tax payments of the San Francisco Local Business Taxes that would otherwise be due on April 30 2020 by taxpayers or combined groups with combined San Francisco gross receipts in calendar year 2019 of 10 million or less. Business Tax Overhaul. San Francisco the City GRT returns and full payment of tax are due by the last day of February of the following yearmonths before federal and California income tax returns are typically filed1 Since gross receipts subject to the GRT include all amounts that constitute gross income for federal income tax.

Quarterly estimated tax payments of the Gross. San Francisco Gross Receipts Tax. 4 For a more in-depth discussion of the Homelessness Gross Receipts Tax please see Deloittes External Multistate Tax Alert San Francisco Tax Update Dec.

The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. Estimated tax payments due dates include April 30th August 2nd and November 1st. 5 San Francisco Cal Ordinance 69-19 Apr.

Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax payments and file an annual tax. The Citys support efforts include the deferral of business taxes and licensing fees as well as the launch of an economic relief fund. Payroll Expense Tax Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior.

1 2014 and ending with 100 percent gross receipts tax for tax year 2018.

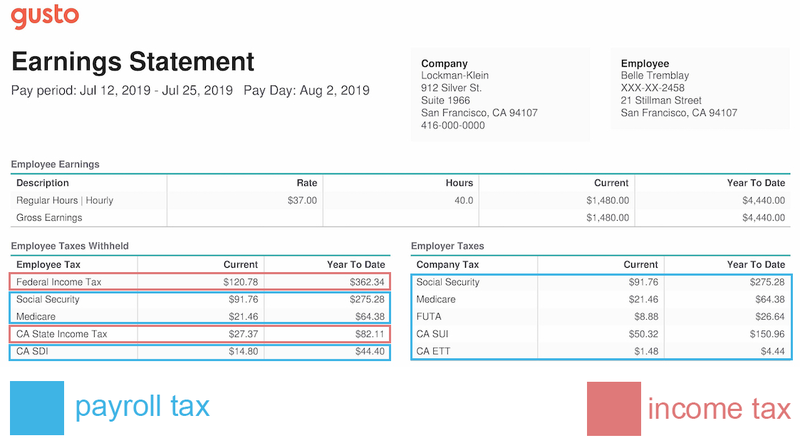

Payroll Tax Vs Income Tax What S The Difference The Blueprint

San Fran Commercial Building Owners Must Pay 2019 Tax Buildings

Due Dates For San Francisco Gross Receipts Tax

San Francisco Taxes Filings Due February 28 2022 Pwc

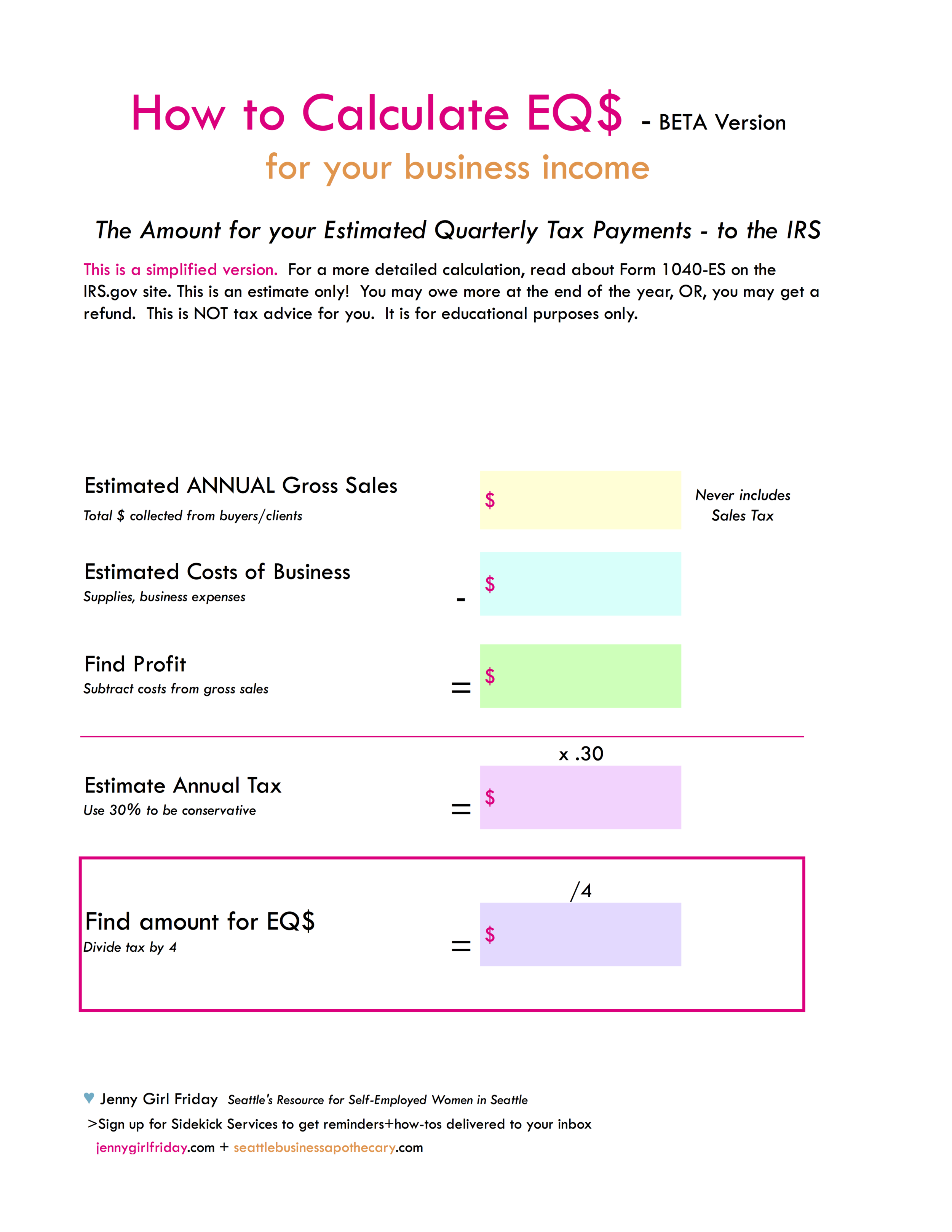

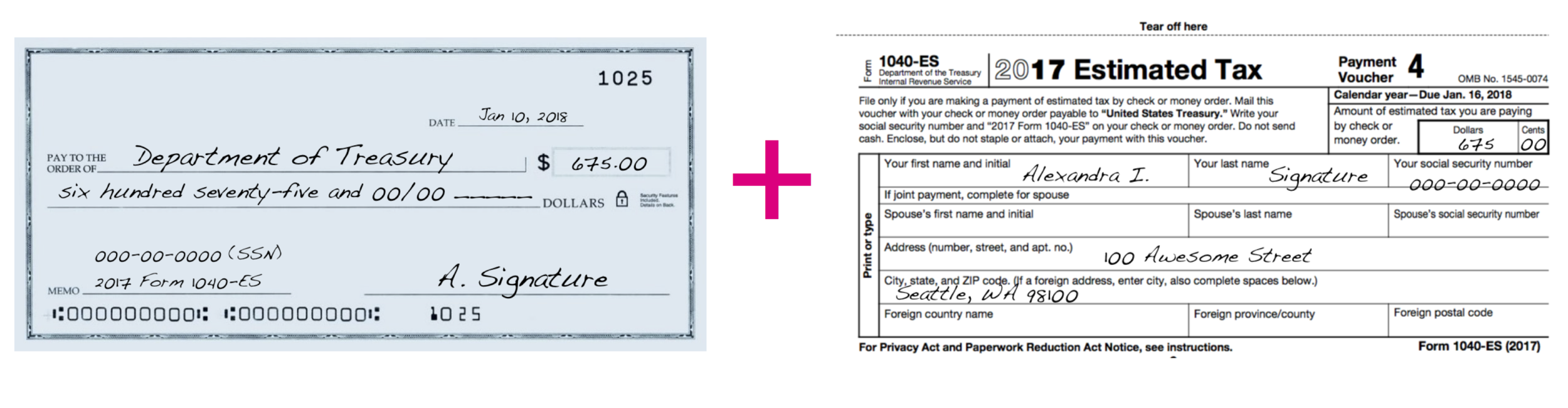

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

Annual Business Tax Return Treasurer Tax Collector

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

San Francisco Gross Receipts Tax

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

What Is A Breakdown For Take Home Pay On A 120 000 Salary Living In San Francisco Quora

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

Annual Business Tax Returns 2021 Treasurer Tax Collector

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax